Americans’ Reluctance to Paying Higher Prices May be Dealing a Final Blow to US Inflation Spike

Consumers have finally met the boundaries of the inflation crisis. Now, after three years of insanity at grocery stores, restaurants, and more, economists say that American consumers simply can’t afford to shop anymore.

Some of the biggest companies in the country, like Amazon and Disney, say that consumers are now taking shopping for cheaper alternatives more seriously. Bargains are now the norm, and companies can’t justify charging inflated prices for the same or worse quality as just a few years ago.

Consumers Are Cutting Back

Economists have been closely observing American shopping behavior for the past few years.

Source: Depositphotos

Although they say that consumers aren’t cutting back enough to cause a drastic economic downturn, they are returning to pre-pandemic norms. Most companies feel that they can’t raise prices anymore without losing business. Clearly, the stalemate between customers and companies has met a head.

Customers Aren't Having It

Tom Barkin, the president of the Federal Reserve Bank of Richmon, said at a conference for business economists last week, “While inflation is down, prices are still high, and I think consumers have gotten to the point where they’re just not accepting it.”

Source: @IALR/X

The struggle between customers and companies has continued for a while now. Barkin added, “And that’s what you want: The solution to high prices is high prices.”

Inflation Has Finally Lowered

Inflation and prices appear to be falling toward the Federal Reserve’s 2% inflation target, which marks an end to painfully high prices that have strained many people’s outlook on life in America.

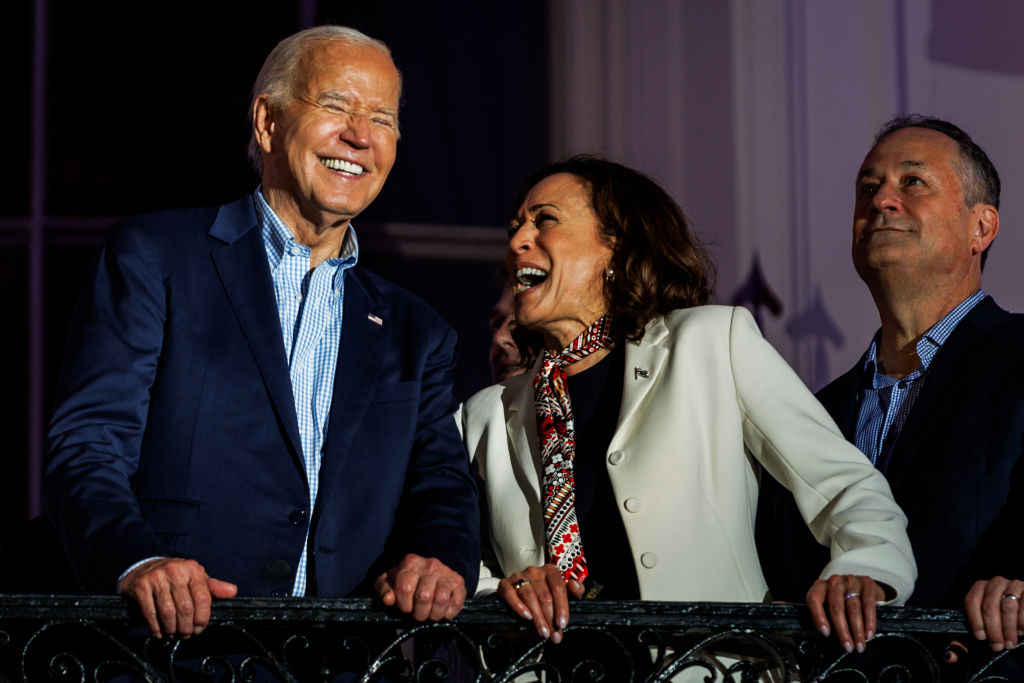

Source: Samuel Corum/Getty Images

Although there are many factors behind the scenes causing high prices, corporate greed, increased cost of goods, unstable international relations, and a logistics crisis, many people have turned to blaming the Biden-Harris administration for their handling of the economy in recent years.

Companies Have Been Forced to Lower Prices

Many economists familiar with the situation say that customers’ inability to shell out any more cash has forced companies to reinstate their normal pre-pandemic prices.

Source: Public Domain/Wikipedia Commons

This phenomenon shows that customer behavior greatly impacts the price of goods and services. When people aren’t willing to pay a premium for regular everyday items, companies will be forced to reduce prices just to retain some of their normal sales.

Consumer Spending Will Rise Over the Next Year

One factor determining how well the economy is doing is how many items are willing to buy in a year. Now that prices have dropped slightly, the Federal Reserve Bank of New York says that Americans will reduce how much they will spend over the next 12 months.

Source: Kidfly182/Wikipedia Commons

Consumers in the US can expect their spending to grow 4.9% in the next year. However, while this number might show that spending is increasing, this is actually the lowest reading since April 2021, when the inflation crisis first began.

Inflation Is Expected to Cool Down

Over the next three years, inflation is expected to remain stagnant at around 2.3%. This is the lowest number seen since 2013, so consumers can be excited about going back to splurging on a few once-in-a-while items.

Source: Jacek Dylag/Unsplash

When inflation is low, people can spend more on big-ticket items like homes, cars, and luxury vacations. However, when interest in items increases, the price also increases. This is a trend that can be easily mapped over the years.

How Consumer Spending Affects the Economy

Outside of exported items, internal sales in a country makes up the bulk of its economic prosperity.

Source: Carl Raw/Unsplash

Two-thirds of all economic activity is fueled by consumer spending. Economists and big banks are looking forward to spending levels rising in the near future thanks to low prices and a healthy unemployment rate.

The Government Will Make a Statement

Sometime this week, the government is expected to share some updates on the inflation crisis and the consumer’s overall health. On Wednesday, the consumer price index for July will be shared with the press.

Source: @RonMilnerBoodle/X

Experts expect prices to increase by about 3.2%, which is down from 3.3% in June. The items will exclude volatile items like energy and food costs.

Retail Sales Are Rising

On Thursday of this week, the government will publish last month’s retail sales, which have climbed as much as 0.3% since June.

Source: Tristan Colangelo/Unsplash

Although this small gain might not show much, it indicates that Americans are still vigilant about their money despite feeling like they can spend on big-ticket items.

Many Businesses Have Noted the Increase

Several businesses have been excited about the increase in sales. Amazon CEO Andrew Jassy said, “We’re seeing lower average selling prices … right now because customers continue to trade down on price when they can.”

Source: @J_K_Chesterton/X

Also, the CEO of Yum Brands, which owns Taco Bell, KFC, and Pizza Hut, David Gibbs, said to his investors that the more cost-conscious consumers have dipped in spending, but at this point, the reduction only stands at about 1%.

Affordable Options Is the Solution

Despite the slight increase in customer sales, some trends have remained the same in recent months.

Source: Wikimedia

Consumers are still going for the value deals, and many fast-food eateries and retailers have noted the change and reduced their overall prices or implemented better deals.