Trump Announces Plans to Increase Chinese Tariffs as the Asian Nation Dumps Over $53 Billion in US Treasuries

Tensions between China and the United States are still rising. Now, China is taking a significant step that further complicates the relationship.

In a historic move, China cuts ties with a record number of US treasuries and agency debt bonds that are worth $53.3 billion. Why did China do this? And what does it mean for the US? Let’s get into it.

A Historic Sell

Noted as the largest sell-off initiated by China, this action coincides with China and other BRICS countries offloading US treasuries worth billions since 2022.

Source: iStock

It’s worth noting that the country has been dumping a record number of treasuries over the last two years.

The Straining Relationship Between the US and China

China’s recent decision another indication that China and other developing countries want to move away from owning US assets in their reserves.

Source: Wikimedia

Despite a meeting between US President Joe Biden and Chinese President Xi Jinping to address the deteriorating relations between their countries, several factors are influencing the future of this worrisome relationship.

BRICS Move Away From the US

BRICS, which groups together the nations of Brazil, Russia, China, and South Africa, have openly voiced their concern about the West’s dominance in the world and aim to counter this by relying less on the US dollar and more on emerging markets in developing countries.

Source: Government of Indonesia/Wikimedia Commons

Since the founding of the group, several other nations have joined, including the UAE, Egypt, Iran, and Ethiopia.

The US Debt Problem

The uncontrolled debt of $34.4 trillion in the US has become a challenge that BRICS does not want any part in. Instead of making their economy rely on the dollar, BRICS wants to rely on local currencies.

Source: Blogging Guide/Unsplash

European countries appear to be following BRICS’s lead, with Belgium dumping $22 billion in treasuries during the same period.

The End of the Dollar

China’s most recent dump of US treasuries aligns with Brics’ goal of dethroning the US dollar, which, according to Al Jazeera, has dominated the global market for the past eight decades.

Source: John Guccione/Pexels

According to Russian President Vladimir Putin, the process of de-dollarization is already well underway. He claims the process is “irreversible” and “gaining pace.”

US Dollar Used in 80% of World Trade

Since the end of World War 2, the US Dollar has been the world’s primary reserve currency, and estimations suggest it is used in up to 80% of international trade.

Source: Marga Santoso/Unsplash

However, this could soon change. Brazilian President Luiz Inacio Lula da Silva has called upon the BRICS members to create their own currency, and should this come to fruition, numerous other nations may begin to dump vast portions of their US treasuries.

Filling the Reserves With Gold

While US treasuries are being sold off, BRICS member China is accumulating massive amounts of gold in its reserves. China, along with the BRICS alliance, reportedly emerged as the largest buyers of gold in 2022, 2023, and 2024.

Source: Jingming Pan/Unsplash

Last year, China purchased several tonnes of gold valued at an estimated $550 billion.

The US-China Trade-War Continues

“As China is selling both despite the fact that we are closer to a Fed rate-cut cycle, there should be a clear intention of diversifying away from US dollar holdings,” said Stephen Chiu, Chief Asia Foreign-Exchange and Rates Strategist at Bloomberg Intelligence (via Watcher).

Source: Freeimageslive

Chiu also noted that “China’s selling of US securities could speed up as the US-China trade war resumes.”

The Fear of the US Presidential Election

One point of caution that many countries are taking into consideration is the upcoming US election. If former president Donald Trump wins the election, the trading war between the US and China could put the US in even more debt.

Source: @GiaDuprey/X

“When the Chinese think about the election next year, Trump coming back would be their worst nightmare,” said Yun Sun, director at the Stimson Center in Washington (via Reuters).

Trump Vs. China

It’s no secret that former US President Donald Trump was never a true fan of China, despite making a historic trade deal during his presidency. However, relationships were tested following the outbreak of coronavirus in 2019, which Trump blamed on China.

Source: Mario Tama/Getty Images

“They should have never let this happen,” Trump said in 2020. “So I make a great trade deal and now I say this doesn’t feel the same to me. The ink was barely dry, and the plague came over. And it doesn’t feel the same to me.”

Trump’s Relationship With XI Worsens

In the past, Trump had expressed he has a good relationship with Chinese President Xi Jinping.

Source: Gage Skidmore/Wikimedia Commons

However, during an interview several years ago, he distanced himself from the leader, whom he blamed for the outbreak, stating, “But I just – right now, I don’t want to speak to him.”

Trump Calls For Restriction on Chinese Visas

Trump went one step further by suggesting US visas for Chinese students should be refused. “There are many things we could do. We could do things. We could cut off the whole relationship,” he replied.

Source: iStock

“Now, if you did, what would happen? You’d save $500 billion,” Trump said, referring to estimated U.S. annual imports from China, which he claims is lost money.

The Tension Builds

Before Trump’s presidency, the US and China had a tense relationship during former President Barack Obama’s term.

Source: Center for American Progress Action Fund/Wikimedia Commons

The all-out trade war that occurred during Trump’s administration was fueled by accusations over the origin of COVID-19 and the status of Taiwan. This conflict was a result of the already high tensions between the two nations.

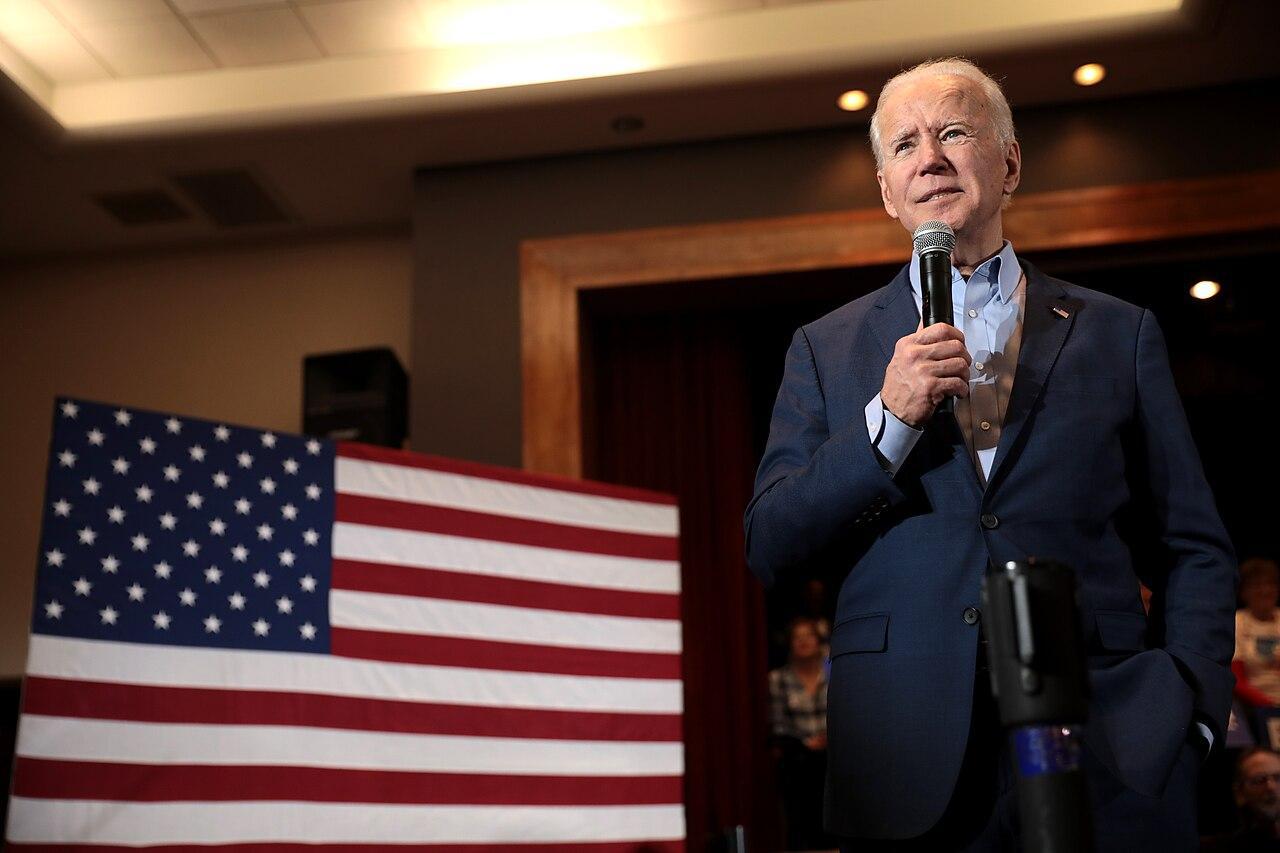

Biden Keeps the Peace

For the time being, Biden has been able to keep the peace between China and the US. He skillfully increased pressure on Beijing by maintaining Trump’s tariffs and adding new export controls.

Source: Wikimedia

However, tension over these new US policies will only increase as authorities crack down on violations.

Cracking Down on China’s Trade

Investigations from the Biden administration’s new task force will be looking into violations involving exports of technology to China.

Source: Wikimedia

In a statement to Reuters, Assistant Secretary of Commerce for Export Enforcement Matthew S. Axelrod said that they “anticipate those efforts to result in significant export enforcement actions in 2024.”

BRICS and China Respond to Biden

While BRICS and China may be unhappy with Biden’s pressure, China’s rulers see Biden as a best-case scenario when it comes to the rules of engagement and maintaining a semi-functional US-China relationship.

Source: The White House/Wikimedia Commons

“Under Trump, there was no meaningful conversation about pretty much anything,” Sun said. “Instead, there was an unstoppable escalation of tension.”

The Future of the US-China Relationship

Perhaps China is responding to the threat of uncertainty rippling through the US economy by selling off treasuries, sparking concern among every country holding US assets in their reserves.

Source: Alejandro Luengo/Unsplash

Sanctions risks appear to be at the forefront of everyone’s minds. China and its close allies hope that bolstering their gold holdings in foreign exchange reserves will maintain stability, even during periods of uncertainty like those experienced by the US.

The Trade War Will Continue Under Trump

If Trump defeats Biden in this year’s elections, he has already revealed plans to implement several new tariffs on China, which would triple down on the trade war he brought against the Asian Nation during his first term.

Source: Michael Candelori/Flickr

In May, Trump called for a 60% tariff on all Chinese goods coming into the US, according to CNN.

Protecting the American People

Trump claims the increased tariffs will help protect working class Americans across the nation.

Source: Gage Skidmore/Flickr

Speaking on Biden’s recent implementation on tariffs, Trump said, ”He wants to put a big tariffs on China, which is the suggestion that I said, ‘Where have you been for three and a half years?’ They should have done that a long time ago,” Trump said.

Trump’s Original Tariffs Worked in a Political Sense

Back in 2018, Trump placed tariffs of around 25% on numerous Chinese-made goods, including washing machines, metal imports, and solar panels, all of which appeared to work in a political sense, according to a paper.

Source: Wikimedia

“Residents of regions more exposed to import tariffs became less likely to identify as Democrats, more likely to vote to reelect Donald Trump in 2020, and more likely to elect Republicans to Congress,” they wrote.

Not Everyone Agrees With Trump's New Tariffs

Not everyone agrees with Trump’s new proposed tariffs, however, and many claim that they could inflict “significant collateral damage on the US economy.”

Source: Freepik

According to some economists, the former US President’s proposed tariffs on China could cost Americans around $500 billion each year, which equates to around $1,700 for each middle-income household.

“Why Trump’s Tariff Proposals Would Harm Working Americans.”

In a new paper published by authors Kimberly Clausing and Mary Lovely, senior fellows at the Peterson Institute, they explained why Trump’s new tariffs would negatively affect the “Hard Working Americans.”

Source: Freepik

“These policies are more likely to hurt than help the lower- and middle-income Americans they purport to benefit,” they wrote. They allege such tariffs could also lead to foreign retaliation and slower economic growth.

The Cost of Retaliation

The chair of tax and policy from the UCLA School of Law spoke with CNN in a phone interview, explaining the $1,700 hit to US families will be just the “tip of the iceberg.”

Source: StockSnap

“The cost of retaliation will be very large. The Europeans will tariff us. The Mexicans and Canadians will be very upset. People aren’t going to take it lying down,” they said.