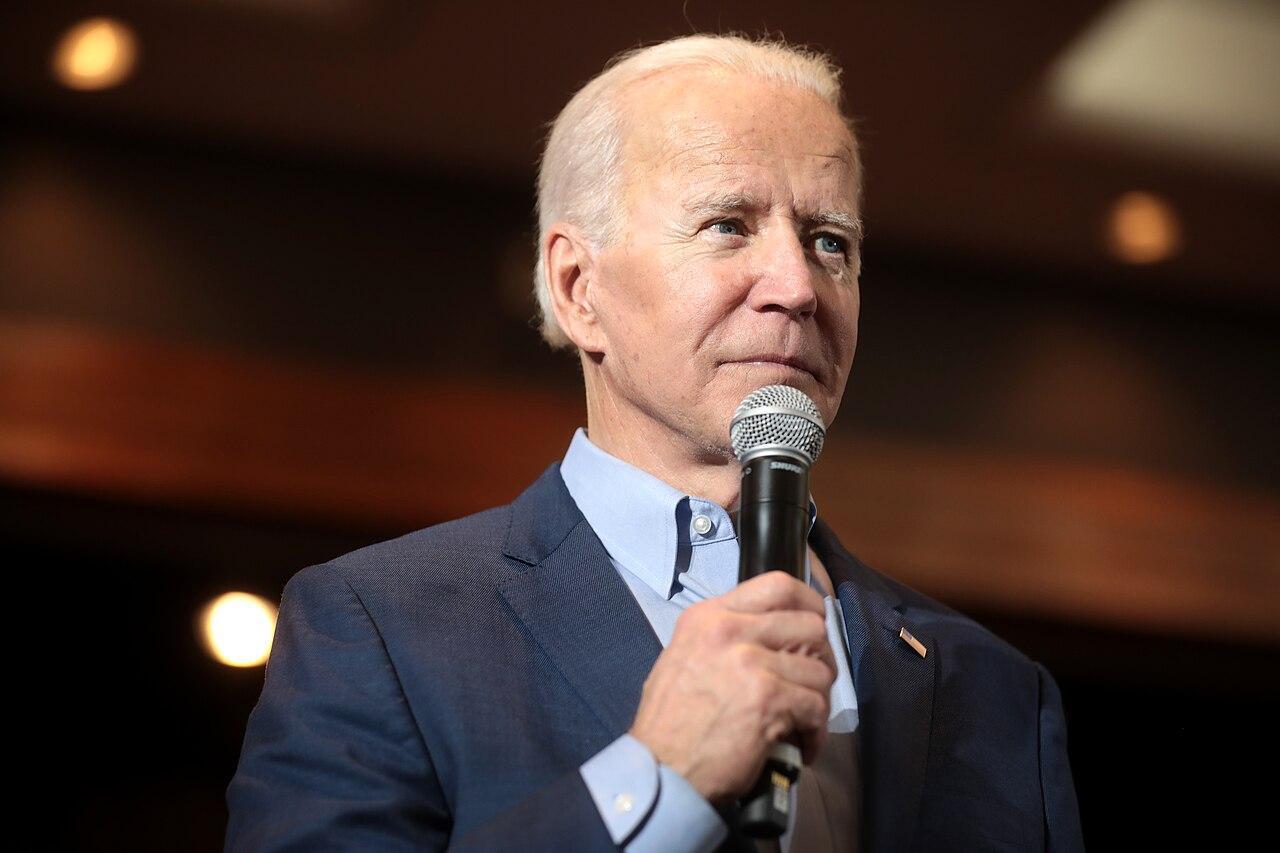

Biden’s Push for Targeted Student Loan Forgiveness Faces Republican Lawsuits

President Joe Biden’s latest plan to forgive student debt is already facing fresh legal battles. A lawsuit filed this week claims the administration is preparing to start discharging billions of dollars in loans as early as Sept. 7, 2024.

Republican-led states, including Missouri, argue the plan is unlawful, as it bypasses judicial review. They’re asking a federal judge to stop the plan before it can take effect.

Missouri Leads the Charge Against Loan Forgiveness

Missouri Attorney General Andrew Bailey is leading the lawsuit to block Biden’s plan, joined by six other Republican-led states. They argue that the education secretary is overstepping legal authority by mass canceling hundreds of billions of dollars in loans.

Source: Wikimedia

Bailey believes this move is politically timed to benefit Biden just two months before the election, a claim that could stir tensions between both parties.

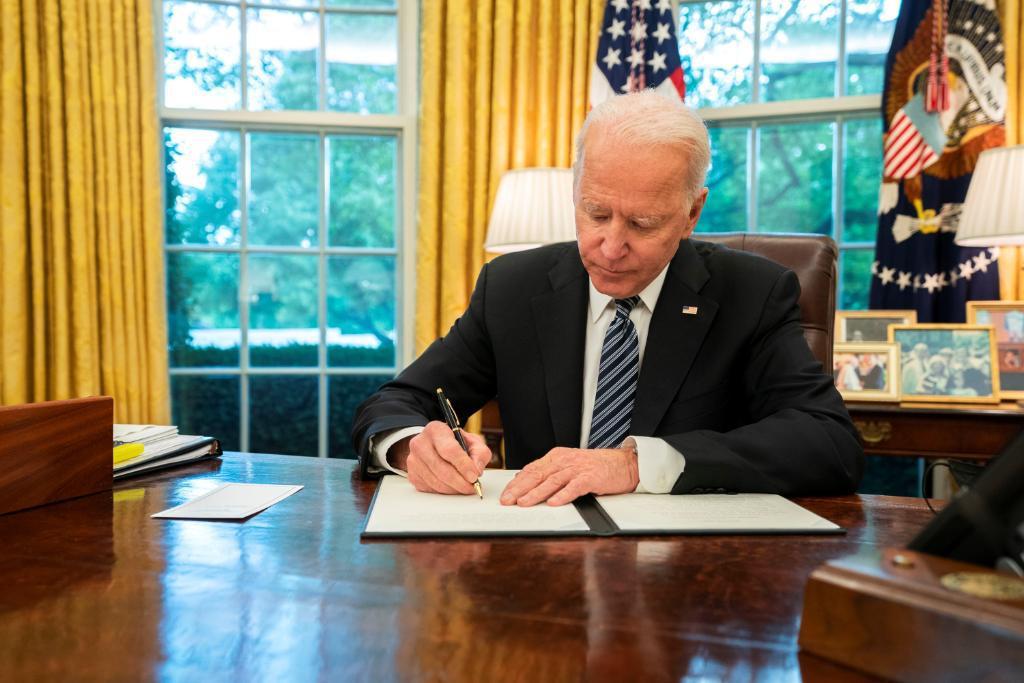

Biden’s Plan Aims to Help Nearly 28 Million Borrowers

The new student loan forgiveness plan is aimed at helping close to 28 million Americans by canceling significant portions of their debt. The plan targets borrowers who have been paying their loans for over 20 years or those whose college programs failed to provide sufficient financial value.

Source: The White House/Wikimedia Commons

Although regulations have not been finalized, the Department of Education has been preparing to implement the plan soon after they are.

Timing Is Key in Legal Battle

The lawsuit argues that the Biden administration is rushing the process to forgive loans before courts have a chance to intervene. The complaint highlights the department’s efforts to finalize regulations quickly, with some plans for discharging loans by Sept. 20.

Source: Freepik

The states are moving preemptively to stop what they see as an “unlawful” action that could forgive billions of dollars in debt without proper legal review.

Automatic Loan Forgiveness on the Horizon

One of the central features of the plan is automatic loan forgiveness for borrowers who owe more than they initially borrowed, as well as those who have been repaying loans for over two decades.

Source: Wikimedia

Eligible borrowers earning less than $120,000 annually could see up to $20,000 of their debt forgiven. This aspect of the plan alone is expected to benefit around 26 million borrowers and cost $62 billion over the next 10 years.

A Costly Component

The Biden administration’s forgiveness plan includes canceling accrued interest for millions of borrowers, particularly those enrolled in income-driven repayment plans. Low-income borrowers could see all their interest wiped out, while others could benefit from partial interest cancellation.

Source: Wikimedia

Republican-led states argue that this part of the plan would cost closer to $73 billion, although the Education Department disputes this figure.

Third Lawsuit in Two Years

This is not the first time Biden’s student loan forgiveness efforts have faced legal challenges. In June 2023, the Supreme Court struck down his original plan, which aimed to forgive up to $20,000 in loans for over 43 million borrowers.

Source: Bhutina65/Canva Pro

Another lawsuit this summer blocked a revised repayment plan. Now, states are hoping to secure a third victory in court by preventing this new attempt at large-scale debt relief.

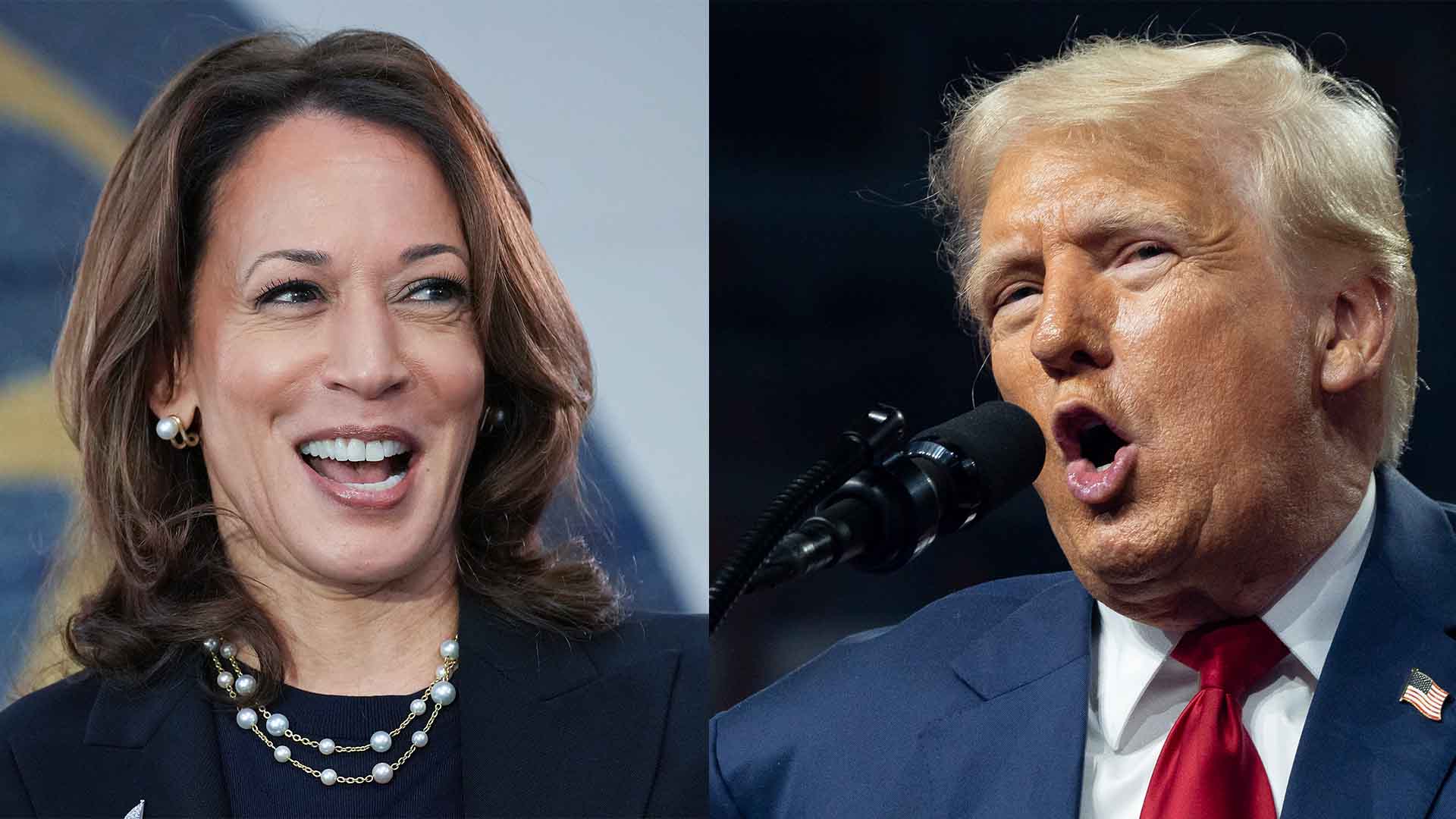

A Political Flashpoint Ahead of the Election

Some Republicans, including Bailey, claim that Biden’s timing is politically motivated, with debt relief planned just two months before the 2024 election. They argue that rushing the plan forward without judicial review is an attempt to curry favor with voters.

Source: Andrew Harnik/Getty Images; Rebecca Noble/Getty Images

Missouri and the other states in the lawsuit are determined to block any action before loans are forgiven, especially with the election looming.

Department of Education Prepares Behind the Scenes

Despite the legal challenges, the Department of Education has been actively working on the logistics of loan forgiveness. Internal documents reveal that federal loan servicers have been instructed to prepare for the loan discharges, including fixing errors in loan balances by early September.

Source: Freepik

Emails to borrowers have been sent out, notifying them of their option to opt out of the relief, suggesting the department is ready to act swiftly.

States Say Forgiving Loans Now Would Create Chaos

The lawsuit emphasizes the potential chaos that could ensue if the Department of Education begins forgiving loans before legal challenges are resolved.

Source: Reddit

Republican states argue that wiping billions of dollars off the books, only to have a court later reverse the decision, would confuse borrowers and create uncertainty. They are pushing for a halt on any loan forgiveness actions until the courts have fully reviewed the plan.

What Borrowers Need to Know

For borrowers, the future remains uncertain. The Biden administration is committed to offering relief, but legal roadblocks could delay or stop forgiveness altogether.

Source: Wikimedia

The final outcome may not be clear for months, as litigation continues.

What’s Next in the Legal Fight?

As the lawsuit progresses, the Department of Education has yet to finalize the regulations necessary for loan forgiveness. The legal process could be lengthy, and borrowers might be left waiting while the courts decide.

Source: Wikimedia

With billions of dollars at stake and the potential for significant political fallout, this legal battle is shaping up to be a major issue in the upcoming election cycle.