Finance Expert Who Predicted Lehman Collapse Warns California is ‘going bust’

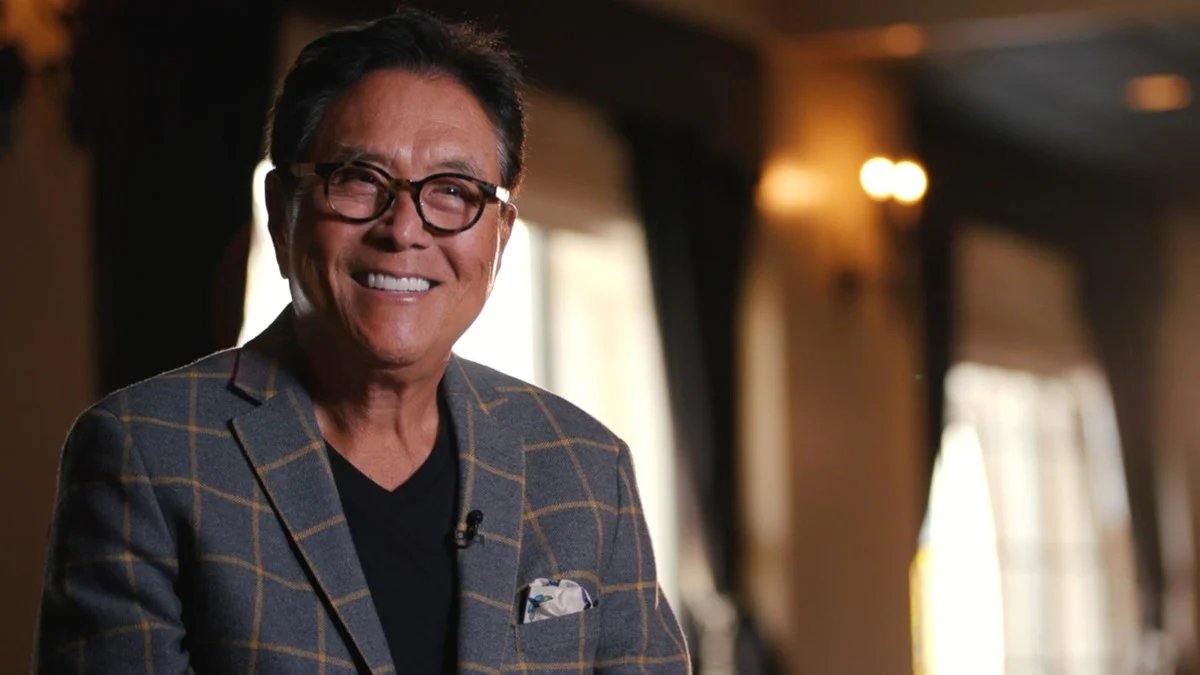

Financial expert Robert Kiyosaki is best known for his hit book Rich Dad Poor Dad, in which he discusses at length the differences in mindsets regarding money.

He recently sat down with Fox News to discuss the grim fate of the financial sector in California. He specifically notes the amount of people leaving the state as a reason why state might soon fall apart.

Financial Expert Weighs In

The financial expert who co-founded the Rich Dad Company warned that California is “going bust” as a result of poor financial management and residents fleeing the state.

Source: @kratos_LF/X

He appeared on the popular talk show, “The Big Money Show,” on Monday to discuss the issues with the Golden State.

Kiyosaki's Background

This isn’t the first time that Kiyosaki has predicted a massive tumble in the financial markets.

Source: @AltcoinDailyio/X

In 2008, the Rich Dad founder predicted the Lehman Brothers collapse, which was fuelled by an overinflated housing market. Big bans were lending mortgages that couldn’t be repaid at record numbers. An economy needs a healthy level of customer spending to survive.

California Is a Jumping Off Point

Kiyosaki noted that he expressed similar sentiments on social media platform X in July.

Source: Eric Chan, Wikimedia

He shared with his followers that “California is a BELL-Weather state. That means what happens in California happens to the rest of the US.” He predicts that an eminent collapse in the west will reverberate throughout the rest of the country, causing financial troubles for everyone.

How Many People Are Leaving California?

According to SoFi, California is the fourth most expensive state in the country with some of the most individually expensive cities, like Los Angeles, San Francisco, and San Diego.

Source: Getty Images

Because of the outrageous housing costs, rent, and high levels of crime and homelessness, people are leaving the state in droves. Since the beginning of the COVID-19 pandemic, the state has been steadily losing residents, causing a massive economic shift in the country.

Big Companies Leaving the State

In the past two years, several big-name companies have announced their departure from the Golden State to less expensive areas like Texas.

Source: Steve Jurvetson/Wikipedia Commons

Oracle, Microsoft, Tesla, X, SpaceX, and others have jumped on the train to move to a state with cheaper housing costs and lower corporate tax rates.

Big Problems in the Golden State

The Rich Dad writer noted a few harsh truths about the states of issues with California’s demographic and their leadership.

Source: Wikimedia

“California will begin raising taxes and cutting subsidies to the poor, to prisons, environmental problems, and teachers unions. That means crime will spread as police will be cut. Since California is a Bell Weather state and is going broke, which states will follow?” he wrote in the post.

Increased Crime As a Major Reason for Moving

Kiyosaki said that he actually moved away from the state this year and wondered how many other high-earning individuals have left the state right behind him.

Source: Jcomp, Freepik

In a survey this year, more than 86% of business owners in California said that crime has increased in their area, while 67% said that they considered moving their company’s headquarters out of the state.

Elon Musk Is Leading the Charge

The conversation quickly turned to the reality that serial entrepreneur Elon Musk has moved almost all of his companies out of the state and is working on moving the others right now.

Source: Wikimedia

“You know, I think it’s interesting that one of the greatest entrepreneurs of our time, Elon Musk, is leaving. What does that tell you?” he asked.

Is There a Recession Occurring Right Now?

It isn’t a secret that inflation and costs are at all-time highs. For the first time in history, adults who work full-time professional jobs cannot afford to buy homes.

Source: Wikimedia

Even more, low minimum wages mean that many must work multiple jobs and cut back on essentials to keep a roof over their head. When people have less cash to spend, businesses and banks often have a hard time keeping up, which has created a minor recession in the market.

Foreign Markets Are Tanking

Last Monday, stocks took a massive hit on the markets as many foreign countries lost trillions in value.

Source: Jezael Melgoza/Unsplash

Excerpts like Kiyosaki point to the issues currently occurring with Chinese and Japanese banks. Both countries have massively raised the interest rates, causing an inability for most residents to buy homes.

Is the Same Coming for the US?

In a report by U.S. News, several factors were discussed regarding what could cause a massive stock market crash in the United States.

Source: Aditaya Vyas/Unsplash

Although they mentioned Japanese banks as a reason that a full crash is coming, they also noted that turbulent markets across the globe are losing points. The US job market isn’t doing terribly, but it is giving off warning signs. Many big tech companies are laying off thousands in hopes of using cheap AI to fuel their business.